How big is the public education system in Texas?

More than 5.4 million children attend Texas public schools and more than 720,000 people work in public education in Texas, including teachers, librarians, counselors, nurses, bus drivers, food service personnel, and custodians.

How does Texas pay for public education?

Most of the cost of public education in Texas is paid for with a combination of state and local funding. State funding comes from state revenue sources, such as the state sales tax, while local funding comes from local property taxes assessed on homes, businesses, land, and mineral rights. The Texas Legislature determines the amount of state funding to put into public education. Local school boards set local property tax rates, but those rates are largely determined by available state funding and by local property values. The Texas Legislature determines the formulas used to distribute school funding.

How does the state decide how much money to send each school?

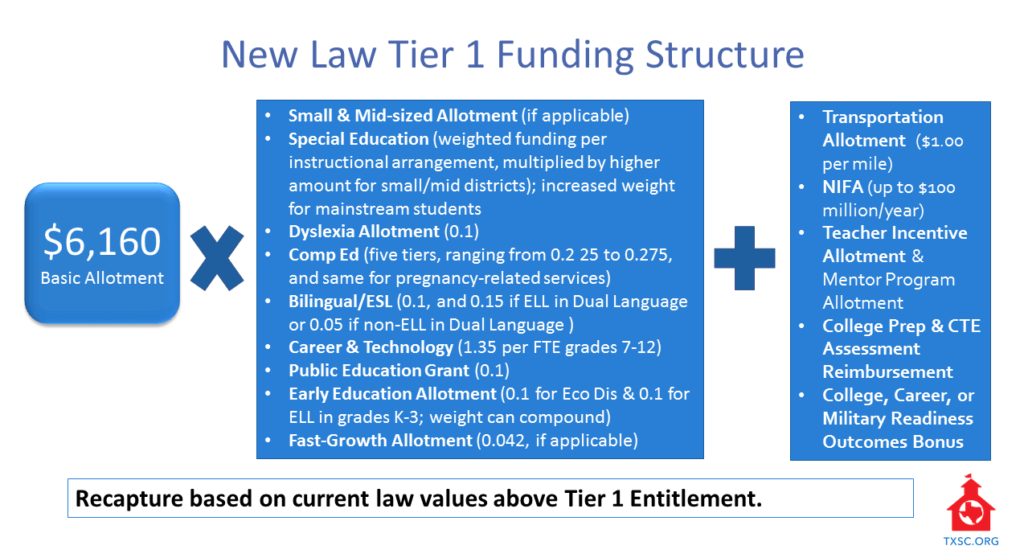

Based on Average Daily Attendance, each school gets a certain amount of money known as the Basic Allotment for every student. The Basic Allotment for fiscal year 2020 is $6,160 per student. Then, a school’s funding is further determined by the district’s tax rate and how many of its students qualify for additional funding weights and allotments based on school district and student characteristics. For example, schools receive additional funding through weights based on how many students are considered economically disadvantaged, are enrolled in bilingual education, or receive special education services (just to name a few).

What is recapture?

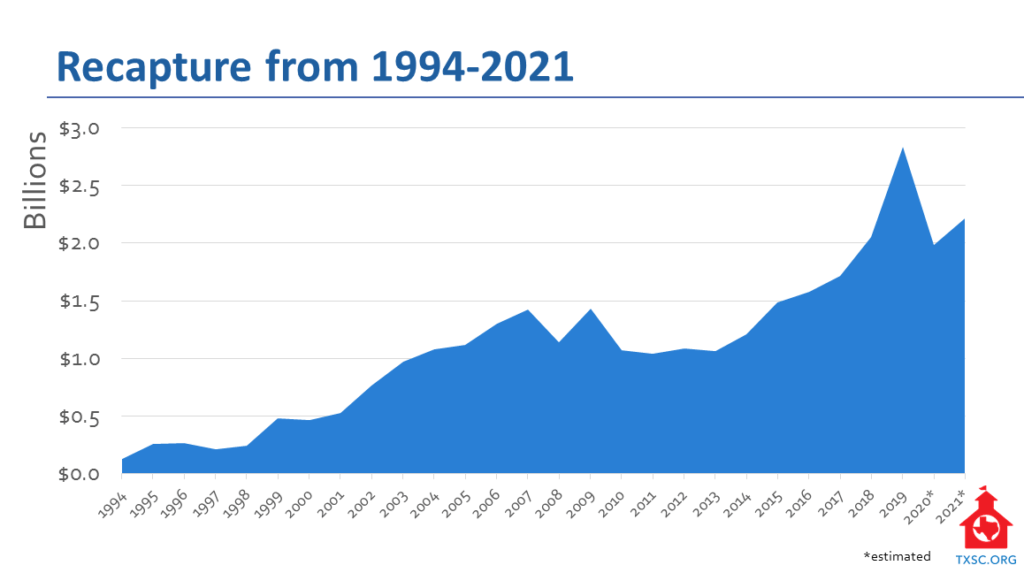

In a 1993 response to court rulings calling for a more equitable school funding system, the Legislature began requiring school districts with higher levels of property wealth per student to pay recapture. Recapture is the process through which these districts send some of their local property-tax revenue to the state. The process is often referred to as Robin Hood. The intent of recapture is to help all school districts have roughly similar amounts of money to spend per child. But over time, recapture has grown considerably, and today recapture payments have grown so large that the state uses those dollars to support a considerable amount of the state’s funding obligation for education, therefore freeing up state funds to be spent on areas of the state budget other than education.

How much do local school districts pay in recapture?

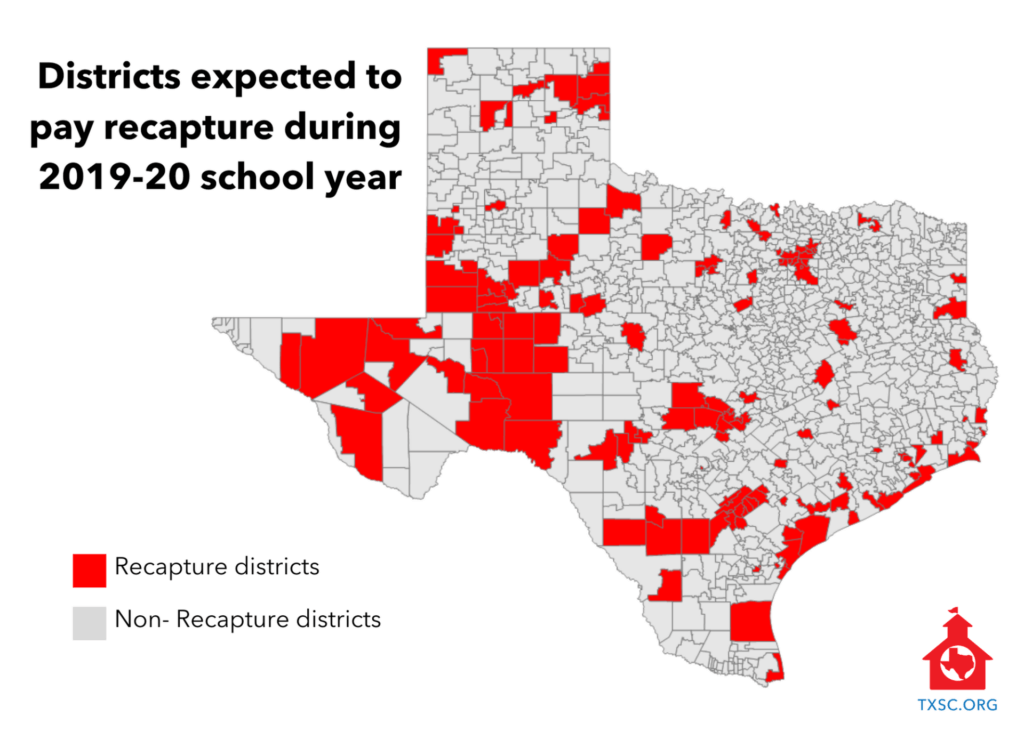

The state will take about $1.9 billion in local property tax dollars out of Texas communities during the 2019-20 school year through recapture. The state is expected to require 141 school districts to pay recapture.

What causes recapture payments to increase?

The system of funding public education relies heavily on local property taxes. And the more the system relies on property taxes, the more it relies on recapture. When property values increase, which they have in recent years, then more of a district’s local revenue becomes subject to recapture unless the district is growing by a proportional amount of students, or if the state chooses to increase its investment in public education. In 2019, the Legislature increased state funding for public education, which caused statewide recapture payments to decrease (though recapture still increased in some districts throughout the state, depending on the district’s property values and student enrollment).

Who are the districts that pay recapture?

Some 141 school districts are expected to pay recapture during the 2019-20 school year. Many of these districts, such as Austin and Dallas ISD, serve students that predominantly come from low-income families. These districts are limited in their ability to meet their students’ needs, because they have to send away much of the money they collect in local property taxes. But if they reduce their tax rates, they will be penalized by the state, and be allowed to keep even less of their local funding. Districts are subject to recapture due to property wealth within the district, but property wealth often does not correlate to personal wealth among the families of students served by the district. Recapture districts can be found throughout the state. Some are very small, while others are some of the largest districts in the state. They are rural, urban, suburban, and every circumstance in-between.