Legislators should balance property-tax relief with investments in students

Dollars spent on property-tax relief are not investments in public education. Those dollars do not reach classrooms and they do not give schools more money to pay teachers and meet other needs.

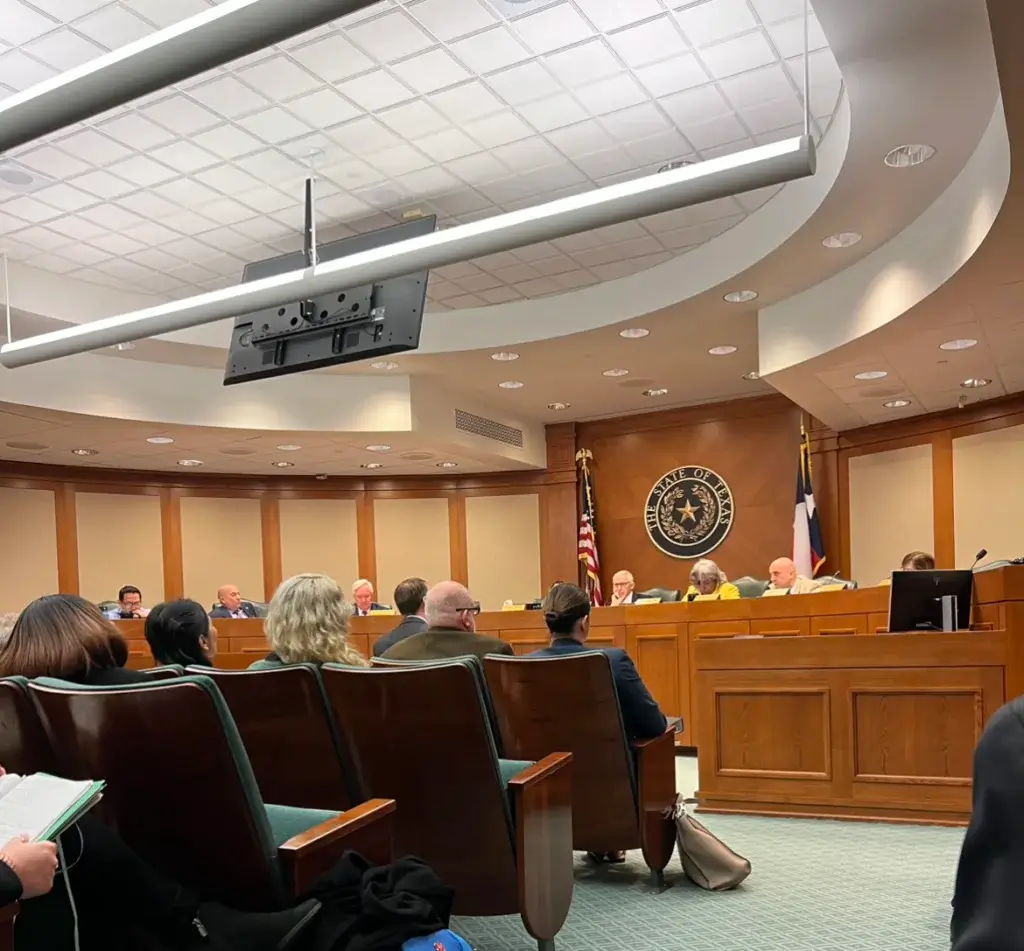

Senate Property Tax Relief Testimony

The Coalition provided testimony to the Senate Finance Committee regarding Senate Bill 3 & Senate Bill 4, which are both measures proposing property tax relief.

HB 2 (Property Tax Relief) Testimony

The Coalition provided testimony to the House Ways & Means Committee regarding House Bill 2, the measure proposing property tax relief.

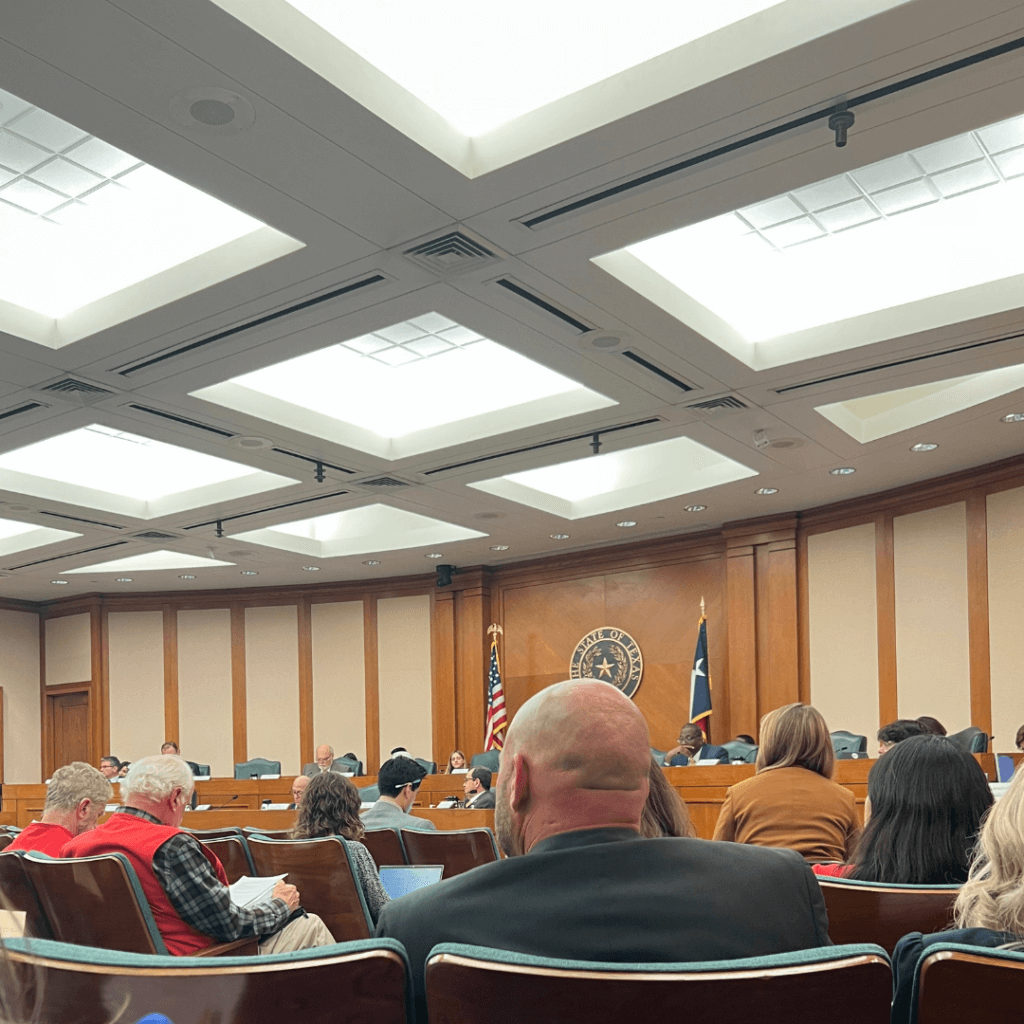

House Appropriations Subcommittee on Article III Testimony – HB 1

The Coalition provided testimony to the House Appropriations Subcommittee on Article III (Education) regarding the state budget, pointing out that recapture has reached nearly $5 billion per year and schools need help meeting the increased costs caused by a 14.5% rate of inflation.

Senate Finance Committee Testimony – SB 1

The Coalition provided testimony to the Senate Finance Committee on the state budget, pointing out that recapture has reached nearly $5 billion per year and schools need help meeting the increased costs caused by a 14.5% rate of inflation.

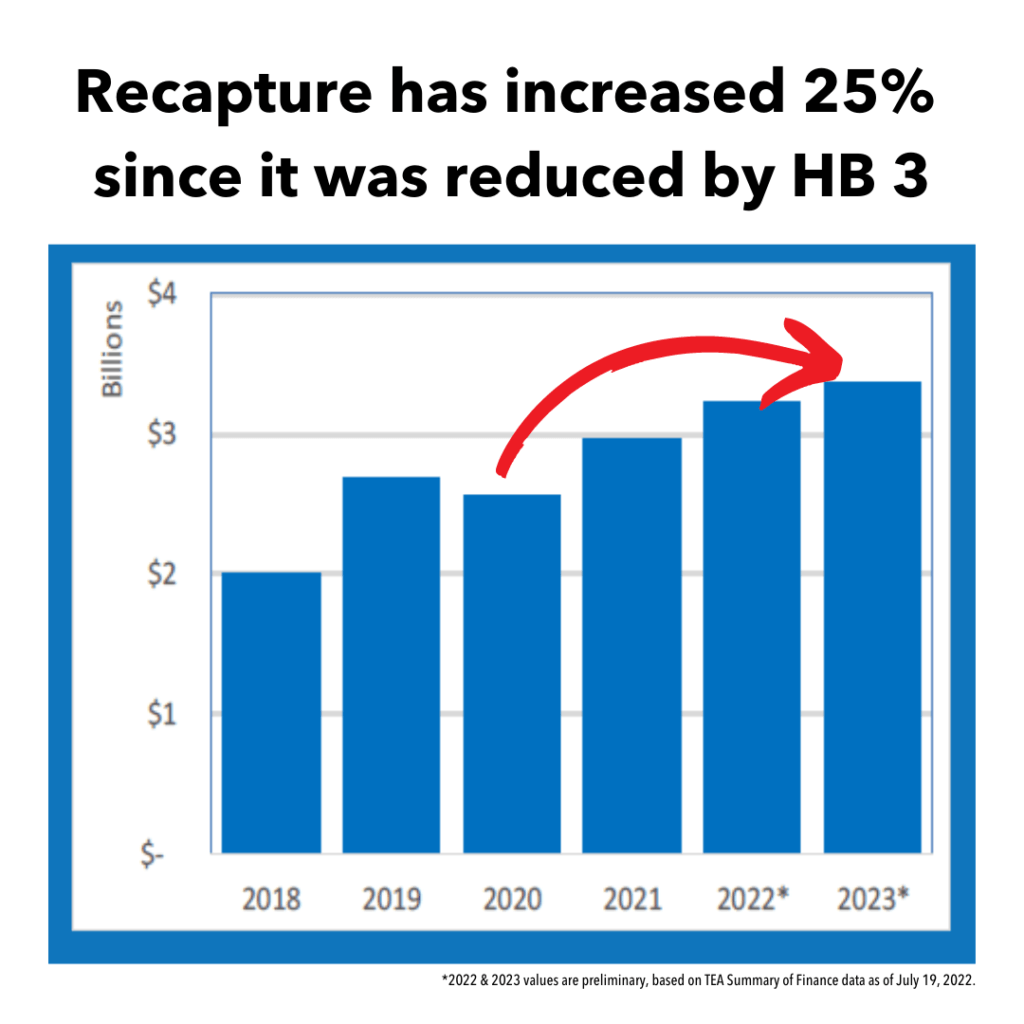

School Finance testimony in House

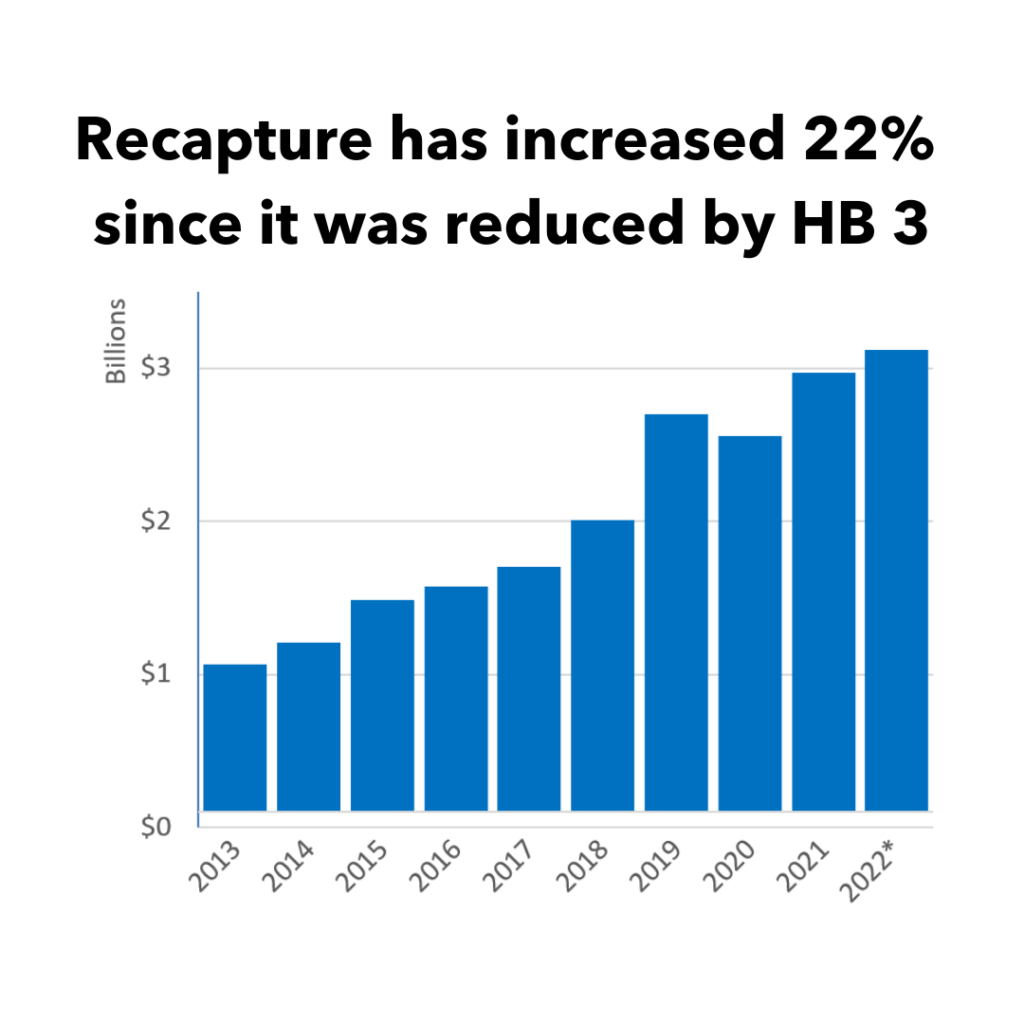

The Coalition provided testimony to the House Public Education Committee on school finance. Since HB 3, inflation has increased by 12%, while school funding has been flat. Since recapture was reduced by HB 3, it has increased by 25%.

School Finance testimony in Senate

The Coalition provided testimony to the Senate Education Committee on school finance. Since HB 3, inflation has increased by 9%, while school funding has been flat. Since recapture was reduced by HB 3, it has increased by 22%.

Balanced, measured approach needed for tax relief

The Coalition provided testimony to the Senate Finance Committee on property tax relief. Limitations to relief mean some taxpayers are paying more, while schools are not beneficiaries of the increased payments. Schools do not receive automatic increases, and a balanced approach is needed.