KEY POINTS TO REMEMBER:

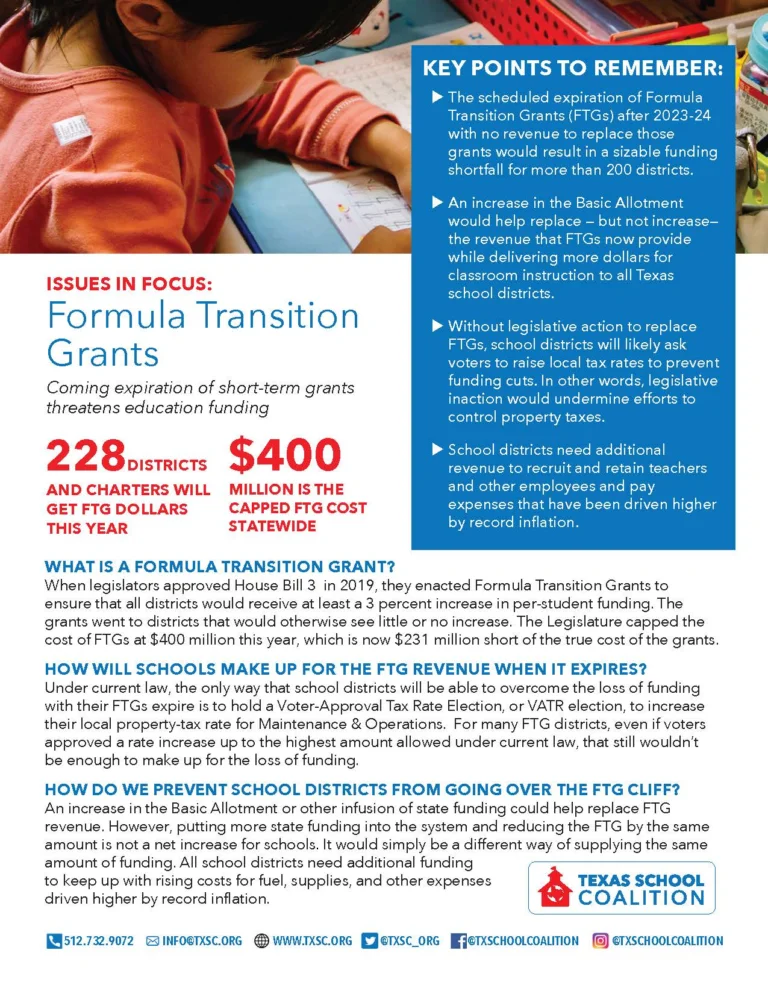

- The scheduled expiration of Formula Transition Grants (FTGs) after 2023-24 with no revenue to replace those grants would result in a sizable funding shortfall for more than 200 districts.

- Without legislative action to extend or replace FTGs, school districts will likely ask voters to raise local tax rates to prevent funding cuts. In other words, legislative inaction would undermine efforts to control property taxes.

- School districts need additional revenue to recruit and retain teachers and other employees and pay expenses that have been driven higher by record inflation.

- Increases in the Basic Allotment could negate the need for some districts to receive Formula Transition Grants. However, when Basic Allotment dollars replace FTG dollars, there is not a net increase in revenue for school districts — just a change in the revenue source. All school districts need a net increase in funding.

WHAT IS A FORMULA TRANSITION GRANT?

When legislators approved House Bill 3 in 2019, they enacted Formula Transition Grants to ensure that all districts would receive at least a 3 percent increase in per-student funding. The grants went to districts that would otherwise see little or no increase. The Legislature capped the cost of FTGs at $400 million this year, which is now $231 million short of the true cost of the grants.

HOW WILL SCHOOLS MAKE UP FOR THE FTG REVENUE WHEN IT EXPIRES?

Under current law, the only way that school districts will be able to overcome the loss of funding with their FTGs expire is to hold a Voter-Approval Tax Rate Election, or VATR election, to increase their local property-tax rate for Maintenance & Operations. For many FTG districts, even if voters approved a rate increase up to the highest amount allowed under current law, that still wouldn’t be enough to make up for the loss of funding. Some are already at the maximum tax rate, with no where to go for additional funds to make up the short-fall.

HOW DO WE PREVENT SCHOOL DISTRICTS FROM GOING OVER THE FTG CLIFF?

An increase in the Basic Allotment or other infusion of state funding could help replace FTG revenue. However, putting more state funding into the system and reducing the FTG by the same amount is not a net increase for schools. It would simply be a different way of supplying the same amount of funding. All school districts need additional funding to keep up with rising costs for fuel, supplies, and other expenses driven higher by record inflation.

WHAT BILLS WOULD HELP WITH THIS ISSUE?

House Bill 100 addresses this issue in two ways: 1) HB 100 increases the Basic Allotment, which helps many schools finally transition to formula funding as intended; and 2) HB 100 includes an extension of the expiration date for the Formula Transition Grant to the 2029-30 school year, to allow time for the formulas to catch up so that all school districts successfully transition to a post-HB 3 world without experiencing any funding cuts.